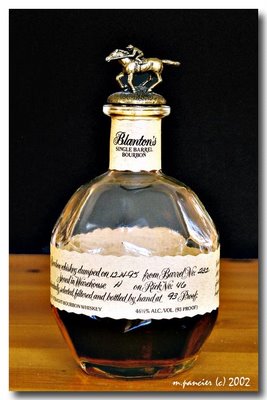

As you can see from my image of my favorite American made spirit, Blanton's Single Barrel Kentucky Bourbon, I'm going to have a drink after work today. Am I going to rant again? Frankly, not. Rather, I am going to give an "I told you so." All these nay sayers and malaise driven tax & spend folks who have repeatedly opposed tax cuts once again are proven wrong. As with JFK, Reagan, and GWB, tax cuts result in an increase of tax revenue. So hopefully you infidels will join me with a drink this afternoon in your favorite tavern or home liquor cabinet and pray that the tax cuts become permanent.

There's a nice piece in today's Wall Street Journal on this piece of good news:

"The real news, and where the policy credit belongs, is with the 2003 tax cuts. They've succeeded even beyond Art Laffer's dreams, if that's possible. In the nine quarters preceding that cut on dividend and capital gains rates and in marginal income-tax rates, economic growth averaged an annual 1.1%. In the 12 quarters--three full years--since the tax cut passed, growth has averaged a remarkable 4%. Monetary policy has also fueled this expansion, but the tax cuts were perfectly targeted to improve the incentives to take risks among businesses shell-shocked by the dot-com collapse, 9/11 and Sarbanes-Oxley.

This growth in turn has produced a record flood of tax revenues, just as the most ebullient supply-siders predicted. In the first nine months of fiscal 2006, tax revenues have climbed by $206 billion, or nearly 13%. As the Congressional Budget Office recently noted, "That increase represents the second-highest rate of growth for that nine-month period in the past 25 years"--exceeded only by the year before. For all of fiscal 2005, revenues rose by $274 billion, or 15%. We should add that CBO itself failed to anticipate this revenue boom, as the nearby table shows. Maybe its economists should rethink their models."

Read the entire article here:

0 comments:

Post a Comment